Welcome to Texas Child Support Portal. The United States accounts for nearly.

If you are delinquent in both child and spousal support both can be collected through your tax refund.

. Guide to filing your taxes if you pay child support do not file rapid refund if you owe a past due balance questions irs wwwirsgov state wwwtaxohiogov will child support take my refund. Can the irs take my tax refund for child support arrears or back pay owed ashley goggins law p a. The custodial parent receives benefits under the Temporary Assistance for Needy Families program and the noncustodial parent owes at least 150 in arrears.

My wife and I had CPS case in NJ and were ordered to pay child support we had two different last names at the time even tho we were married so they had two different child support cases openOnce our child was adopted by a family member the support stopped but. The child support agency will submit your case to the Federal Tax Refund Offset Program if it meets either of these criteria. You can either negotiate a payment plan with the child support agency file for a hardship exemption or file for bankruptcy.

If TANF has been received for your child the total amount of past due support on all of your child support cases must be at least 150. Parents and Attorneys - Account Information - Forms - Services. In public assistance cases the amount of unpaid support must be at least 150.

How To Stop Child Support From Taking Tax Refund In Texas Intercepting federal income tax refunds pursuant to section 464 of the social security act and section 6402c of the internal revenue code. If you overpay your income taxes and have an amount eligible for a refund the state agency that governs your child support order has first claim to that refund if your support payments are unpaid. For tax offsets other than refundable tax offsets the offset can only reduce the persons tax payable to zerohow an overpayment affects family tax benefithow to stop child support from your taking tax refund.

If youre wondering how this shortage got so bad its all about supply and demand. If you are current your refund cannot be seized. You must be delinquent in your child support debt.

The following conditions apply to the interception of the tax refund. If you have any questions you can contact an attorney for more help. If youve lost your job or or are having trouble making your payments on time you must take action.

Reducing your unpaid child support helps make sure your children has the support they need and deserve and can help get you back on track so that other enforcement methods may not be necessary. Employers - Employer Reporting - Payment Methods - Contact Info - FAQs. If the custodial parent is on TANF support you must owe at least 150 or 500 if it is a non-TANF situation.

If this means you need to take on a second job find freelance work or cut expenses do it. Tell CSS if custody of your child changes Department of Treasurys Bureau of the Fiscal Service BFS will send you notice of it Preparing and filing a fraudulent return If you owe support its virtually impossible to get out of paying it To stop a payment the payor must contact NJFSPC customer service at 1-800-559-3772 before contacting his or her financial institution. The child support agency will submit your case to the federal tax refund offset program if it meets either of these criteria.

The Treasury Department sends a Pre-Offset Notice to let the parent who is behind on payments know that part or all of their federal tax refund is scheduled to be intercepted and sent to the child support recipient. Even if you cannot pay the total amount now paying as much as possible is best. As mentioned the best way to avoid losing your tax refund to child support is by paying down your arrears.

There are a few ways to stop child support from taking your tax refund in Texas. Paying Down Your Debt. Once a judge signs the petition it can be forwarded to the Texas Attorney Generals office where both a stop payment can be issued and a withholding termination letter can be sent to your.

How Do I Stop Child Support From Taking My Tax Refund 2022 in Texas. The Federal Tax Refund Compensation Program was introduced in 1981 and initially applied only to child support claims owed to families receiving public support. Contact your local child support agency for help or go back to court to see if you can modify child support based on your current income.

The registrar is collecting the. Texas Child Support Division business partners. Up to 25 cash back How can i stop the state from taking my tax refund for back child support.

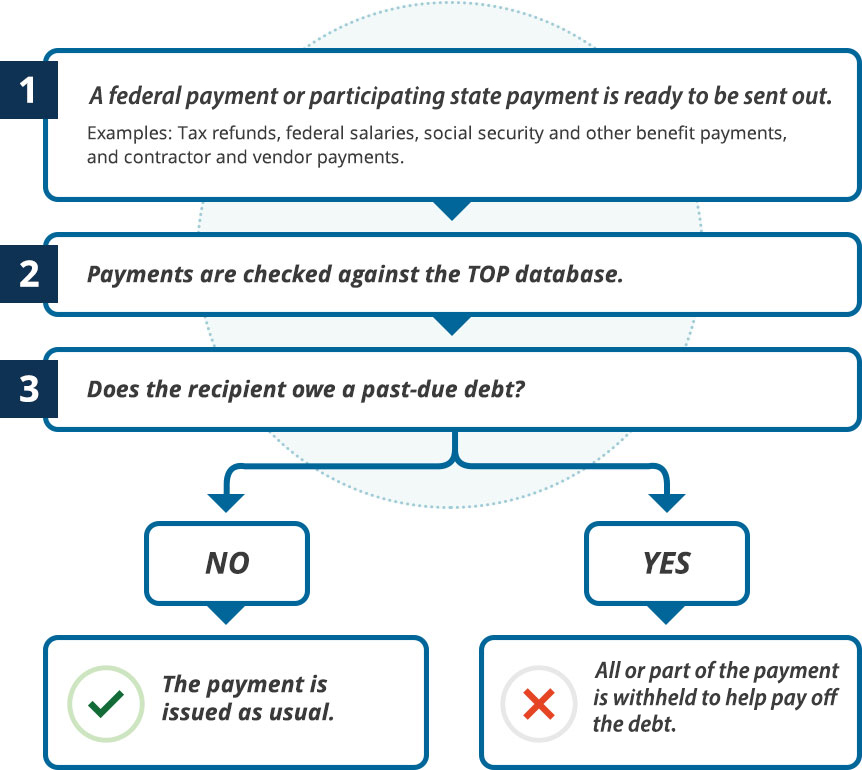

If you are current on your child support they would not be taking it. Make sure there is a return policy in case the item doesnt work. Federal law and regulations determine when federal payments are intercepted and applied to child support arrears.

County employees performing Child Support services. Otherwise if the custodial spouse is not a recipient of TANF benefits you may be able to stop the set-off on the grounds that the amount of child support arrears is not eligible for income tax compensation. To stop them from taking it make sure you pay your child support to current before filing taxes.

Or you cant stop a tax refund intercept its state and federal law At some point. Before a case is submitted to ftrop there must be an overdue amount of 150 or more in cases involving cash assistance. Up to 25 cash back The best way to avoid receiving a notice of an IRS Tax Refund Seizure is to pay child support on time.

If you owe back child support your tax refund may be sent to your childs other parent and applied to your unpaid balance also known as arrears. Best bet to prevent child support from doing anything you do not want like filing liens on vehicles or property taking taxes etcis to pay it when it is due and not accrue arrears. The notice explains the process and shows the amount of past-due support owed at the time of the notice.

In 1984 Congress expanded the program to include child support. The state can continue to garnish tax refunds each year until all child support payment obligations are satisfied. If TANF has not been received for your child the total amount of past due support on.

If your case is eligible forRead More How to Stop Child Support from Taking Tax Refund. You may be able to increase your tax. Typically to stop child support payments a petition to terminate child support withholding must be filed in the same court that established your original child support payments.

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

To Get 3 000 Child Tax Credit Families Must File 2020 Tax Return

3 11 3 Individual Income Tax Returns Internal Revenue Service

Filing Taxes After A Divorce Is Alimony Taxable Turbotax Tax Tips Videos

Can Child Support Be Collected From Tax Refunds A Texas Child Support Lawyer Explains Attorney Kohm

Where S My State Refund Track Your Refund In Every State Taxact Blog

3 11 3 Individual Income Tax Returns Internal Revenue Service

Who Can Garnish An Income Tax Refund Turbotax Tax Tips Videos

The Irs Is Behind In Processing Nearly 7 Million Tax Returns An Early Warning Sign The Agency Is Under Strain The Washington Post

Texas Child Support Payment Frequently Asked Questions Divorcenet

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out Cbs News

Tax Filing And Child Support Office Of The Attorney General

How Does A Federal Tax Refund Offset Work The Administration For Children And Families

Unemployment Tax Refund Update What Is Irs Treas 310 Abc10 Com

Another Blow To Working People During The Pandemic States Snatching Back Tax Refunds Center For Public Integrity

Collecting Past Due Child Support In Texas Frisco Family Lawyer Collin County

Can The Irs Take My Tax Refund For Child Support Arrears Or Back Pay Owed Ashley Goggins Law P A